Checking Out New York Property Financial Investment Opportunities

New york city has long been a beacon genuine estate financiers due to its vibrant market, strong economic situation, and famous global standing. From Manhattan high-rise buildings to enchanting upstate towns, New york city provides varied home financial investment chances customized to numerous financial goals and strategies. Whether you have an interest in rental residential properties, commercial areas, or mixed-use advancements, New york city's real estate market holds immense capacity.

This write-up explores why purchasing New york city property is a profitable venture, the top chances offered, and crucial suggestions for success.

Why Purchase New York City Realty?

1. Strong Market Demand

New York's population density and influx of travelers guarantee steady demand for domestic, industrial, and vacation rental properties.

2. High Rental Returns

In areas like Manhattan and Brooklyn, rental costs regularly rank amongst the greatest in the country, providing substantial capital for property managers.

3. Economic Resilience

Regardless of financial fluctuations, New york city's realty market shows exceptional resilience as a result of its condition as a global service hub and social epicenter.

4. Diversity Opportunities

From high-end condos in the city to holiday rentals in upstate regions like the Hudson Valley, New york city provides varied investment options to expand your portfolio.

Top Property Financial Investment Opportunities in New York City

1. Residential Characteristics

Buying multi-family units or single-family homes can generate high returns, especially in city centers with strong rental markets. Secret communities to take into consideration include:

Manhattan: Known for premium costs however solid lasting appreciation.

Brooklyn: Offers slightly lower entrance expenses than Manhattan with growing demand.

Queens: An emerging hotspot for budget friendly household financial investments.

2. Vacation Rentals

Upstate New york city areas like Saratoga Springs, the Catskills, and the Finger Lakes are ideal for temporary trip leasings. These areas attract tourists year-round, especially throughout summer season and winter.

3. Industrial Real Estate

Office, retail stores, and mixed-use growths in New York City's enterprise zone or growing residential areas use considerable income possibility. Locations like Hudson Yards and Downtown Brooklyn are experiencing raised financier interest.

4. Affordable Housing Projects

With real estate shortages in city areas, affordable housing developments are backed by motivations and demand, making them a appealing endeavor.

5. Fix-and-Flip Opportunities

Communities undertaking gentrification, such as parts of Harlem or the Bronx, present financially rewarding opportunities for building flipping.

Finest Areas for Home Financial Investment in New York City

1. New York City City

The city's 5 boroughs offer countless opportunities, especially for high-end, business, and multi-family residential investments.

2. Long Island

This suburban area integrates distance to the city with high need for single-family homes and trip services.

3. Upstate New York City

Areas like Albany, Rochester, and Buffalo are ideal for budget-friendly building financial investments with solid rental possibility.

4. Hudson Valley

A preferred resort for metropolitan experts, Hudson Valley uses appealing holiday leasing and domestic investment opportunities.

Trick Factors To Consider for Buying New York City Property

1. Research Study Market Trends

Comprehending trends like populace shifts, rental demand, and building recognition prices will guide smarter financial investments.

2. Evaluate Financing Options

Check out mortgages, collaborations, or leveraging existing equity to finance your financial investments efficiently.

3. Consider Property Taxes

New york city's property taxes vary significantly by region, influencing general productivity. For instance, New York City taxes differ from upstate locations.

4. Companion with Professionals

Regional property agents, home supervisors, and legal advisors can assist you browse New York's complex market.

5. Examine Property Condition

Whether buying for rental or resale, a complete inspection is essential to prevent unforeseen expenses.

Tips for Success in New York City Building Financial Investment

https://greenspringscapitalgroup.com/blog/ Expand Your New York property investment opportunities Portfolio: Spread investments throughout different home types and places to reduce dangers.

Invest in Emerging Neighborhoods: Locations on the verge of growth usually supply better ROI than well-known hotspots.

Utilize Innovation: Use devices like Zillow, LoopNet, and CoStar to assess market data and find lucrative bargains.

Remain Updated on Regulations: New york city has particular rental fee control regulations and zoning policies that investors need to adhere to.

Focus On Sustainability: Qualities with environment-friendly features draw in modern tenants and may receive tax obligation rewards.

Obstacles of New York Building Investment

While the chances are vast, financiers need to also get ready for obstacles such as:

High First Costs: Especially in New York City, building prices are among the greatest in the country.

Open Market: Need usually exceeds supply, especially in desirable communities.

Complicated Legal Landscape: Comprehending occupant legal rights and realty legislations in New York needs diligence.

New York offers unrivaled residential or commercial property investment opportunities varying from city high-end advancements to peaceful upstate vacation services. By performing complete research study, diversifying financial investments, and dealing with industry experts, you can take advantage of among one of the most dynamic realty markets worldwide.

Beginning discovering New york city's vibrant residential property financial investment scene today and unlock the possibility for economic development and lasting wide range creation.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Alicia Silverstone Then & Now!

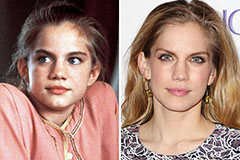

Alicia Silverstone Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!